Another Lesson Learnt From Deep Value Investing - Krisenergy Ltd

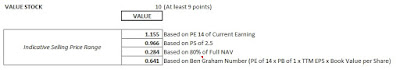

After reading about Investment Moats latest post on Swiber Holding Ltd and his comments on Deep Value Contrarian Investing, I made a comment: "Hi If an investor is using Deep Value Contrarian style (like me sometimes), he must be able to understand it is “HIGH RISK, high return” – note the capital letters. He must also have experience, able to endure the ups and DOWNS (mostly downs) and understand financials as well as the business model. He must also be able to exit when something goes wrong. Only by understanding these factors, then should the person go into deep value investing. Looking forward to your next post! Regards, TUB Investing" Therefore I will emphasize again - Deep Value Contrarian Investing is a high return but also HIGH RISK style. I have been engaging in some of this investment style since March 2016 and the results have some far been slightly better than average . But it should have been better. Other than the factors I stated above, deep value in