Triple S Scorecard (Previously named as V Scorecard)

Warning: This will be an extremely long post.

Updated: The Scorecard has been rename from "V Scorecard" to "Triple S Scorecard"

Updated: The Scorecard has been rename from "V Scorecard" to "Triple S Scorecard"

After 1 month of reading plus 2 weeks of using my "after office hours free time", I managed to create my new value scorecard - which I renamed as "V Scorecard" (sounds more atas right?).

This idea came about because I felt my previous scorecard is not complete and focused more on earnings than balance sheet (which is not really in line with value investing).

I wanted to do some coaching as well, so I felt a more informative scorecard is required (not that I think I am super good. My portfolio is down about 5% in general this year.).

I also realized the previous scorecard is also quite tedious on retrieving information and lazy people will be turned off by it. Thus, a more informative scorecard with minimal input is sought after.

Information which I gather from, for the V scorecard, was stated in my previous post.

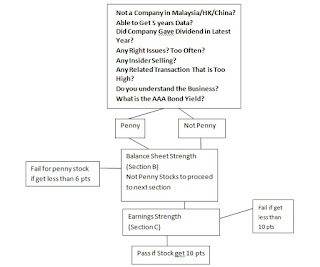

The Flow Of V Scorecard

V Scorecard is split into different sessions.

The first session is a list of subjective questions. If you are able to answer the 8 questions correctly, then you can proceed to the next session.

The second session will be for you to input the necessary information.

Then, V Scorecard will determine if your stock is a Penny (Below $150 Million Market Cap) or Not a Penny Stock (Above $150 Million Market Cap).

After that, V Scorecard will test the strength of the company's Balance Sheet (as explained in Section B below). If the company is a Penny Stock and get less than 6 points for this part, then it will fail the test. If it gets more than 6 points, it will proceed to Section C.

If the company is deem not a Penny Stock, it will proceed directly to Section C.

Section C will test the strength of the earning ability of the company.

Then, V Scorecard will total up the points and if the stock achieve a high score of 10 or above, it will be deem as a Value Stock (With a maximum of 15 points).

V Scorecard will also help to tabulate the selling price for the stock via 3 different ratios (Price to Book, Price to Earning and Price to Sales). This is new and I find very helpful for myself as I have a rough gauge of the price that I should sell the stock.

However, user should also exercise caution when they intent to base their decisions on these selling prices. These selling prices are just indicators, similar to those in analyst reports. Absolute faith should not be placed in these numbers.

Section B

1. Net Current Asset Value should be higher than Share Price.

- Based on Benjamin Graham Criteria

2. Net Asset Value must be higher than Share Price.

- In my own opinion, Shares in Singapore Stock will be priced at a lower price than its NAV.

3. Cash as a % of Current Assets must be more than 40%

- In my opinion, having more cash will allow the company to endure through tough times and the ability to create more value in future (M&A, Increase Dividend, Buy machines, etc)

4. Current Ratio must be more than 2

- Based on Benjamin Graham Criteria

5. Total Liabilities to 2/3 Tangible Book Value must be less than 1

- Based on Benjamin Graham Criteria

- Based on Benjamin Graham Criteria

6. Debt to Tangible Book Value must be less than 30%

- Based on Net Net Hunter

- Based on Net Net Hunter

7. Dividend Yield must be more than 3%

- Enhanced View of a combination of Benjamin Graham Criteria and my own opinion

- Enhanced View of a combination of Benjamin Graham Criteria and my own opinion

8. Dividend Payout must be less than 80% for 2 of the last 3 years

- In my opinion, a company must be able to sustain dividend payment without paying off all their net profit. Excess profit will eventually be deem as assets and increase its Net Current Asset Value.

- In my opinion, a company must be able to sustain dividend payment without paying off all their net profit. Excess profit will eventually be deem as assets and increase its Net Current Asset Value.

9. Dividend Yield to Price to Book must be below 7.8 (Highest 20%)

- Based on Show Me The Money Book

Section C

10. Trailing Earning Yield must be above 2 times of the AAA Bond Yield

- Based on Benjamin Graham Criteria

11. Profit Margin for the last 5 years must be at least 5% for at least 4 out of the 5 years

- In my opinion, a company must be able to sustain a minimum of 5% for a pro-long period to show its earning capabilities.

12. 5 year Average Price to Earning Ratio must be below 10

- Based on Value Investing: Tools and Technique for Intelligent Investment by James Moniter

13. Price to Trailing 1 Year Sales must be below 1.5

- Based on Value Investing: Tools and Technique for Intelligent Investment by James Moniter

14. Current Trailing Price to Earning Ratio must be below 8 (lowest 20%)

- Based on Show Me The Money Book

Back Test on Stocks from 2013 and 2014

After reading the Show Me The Money book, I decided to do a back test on the criteria of V Scorecard.

I intend to pick out the stocks that pass the stated criteria during the Nov 2013 to Nov 2015 period. From there, I will find out which of these stocks that passed the criteria, had actually increased in price over the period of 1 year and 2 years. Then the probability of a stock that pass the V Scorecard, and will also increase in its stock price, will be tabulated.

A maximum of 2 year period is chosen because in the Show Me The Money Book, there is an article that states that Value will be unlocked or tend to appear after 2 years.

Due to the heavy workload, I will only be testing only part of the criteria.

With the help from Stockflock.co, I am able to retrieve the stocks that pass the following criteria:

1. Current Ratio more than 2

2. Total Liabilities to Equity is less than 0.65

3. Quick Ratio more than 1 (An indicative that Current Assets have significant Cash)

4. Must have dividend the previous year

For 2013 - 92 stocks passed

For 2014 - 99 stocks passed

Based on the result above, the observation are:

1. 54 stocks (out of 92 stocks) price has increase from Nov 2013 till Nov 2014 (1 year period). This is about 58.7% of the total stocks that passed the 4 criteria.

2. 47 stocks (out of 92 stocks) price has increase at least 5% from Nov 2013 till Nov 2014 (1 year period). This is about 51.09% of the total stocks that passed the 4 criteria.

3. 38 stocks (out of 92 stocks) price has increase at least 10% from Nov 2013 till Nov 2014 (1 year period). This is about 41.3% of the total stocks that passed the 4 criteria.

4. 38 stocks (out of 99 stocks) price has increase from Nov 2014 till Nov 2015 (1 year period). This is about 38.38% of the total stocks that passed the 4 criteria.

5. 33 stocks (out of 99 stocks) price has increase at least 5% from Nov 2014 till Nov 2015 (1 year period). This is about 33.33% of the total stocks that passed the 4 criteria.

6. 28 stocks (out of 99 stocks) price has increase at least 10% from Nov 2014 till Nov 2015 (1 year period). This is about 28.28% of the total stocks that passed the 4 criteria

But if we look at a period of 2 years (from Nov 2013 to Nov 2015)

7. 49 stocks (out of 92 stocks) price has increase over the 2 year period. This is about 53.26% of the total stocks that passed the 4 criteria.

8. 41 stocks (out of 92 stocks) price has increase at least 5% over the 2 year period. This is about 44.57% of the total stocks that passed the 4 criteria.

9. 38 stocks (out of 92 stocks) price has increase at least 10% over the 2 year period. This is about 41.30% of the total stocks that passed the 4 criteria.

In addition, I decided to add a criteria - Dividend Yield to be at least 3% that year.

For 2013 - 63 stocks passed the 5 Criteria

For 2014 - 64 stocks passed the 5 Criteria

Based on the table above, the observation are:

1. 41 stocks (out of 63 stocks) price has increase from Nov 2013 till Nov 2014 (1 year period). This is about 65.08% of the total stocks that passed the 5 criteria.

2. 35 stocks (out of 63 stocks) price has increase at least 5% from Nov 2013 till Nov 2014 (1 year period). This is about 55.56% of the total stocks that passed the 5 criteria.

3. 27 stocks (out of 63 stocks) price has increase at least 10% from Nov 2013 till Nov 2014 (1 year period). This is about 42.86% of the total stocks that passed the 5 criteria.

4. 29 stocks (out of 64 stocks) price has increase from Nov 2014 till Nov 2015 (1 year period). This is about 45.31% of the total stocks that passed the 5 criteria.

5. 25 stocks (out of 64 stocks) price has increase at least 5% from Nov 2014 till Nov 2015 (1 year period). This is about 39.06% of the total stocks that passed the 5 criteria.

6. 20 stocks (out of 64 stocks) price has increase at least 10% from Nov 2014 till Nov 2015 (1 year period). This is about 31.25% of the total stocks that passed the 5 criteria

If we look at a period of 2 years (from Nov 2013 to Nov 2015)

7. 37 stocks (out of 63 stocks) price has increase over the 2 year period. This is about 58.73% of the total stocks that passed the 5 criteria.

8. 30 stocks (out of 63 stocks) price has increase at least 5% over the 2 year period. This is about 47.62% of the total stocks that passed the 5 criteria.

9. 27 stocks (out of 63 stocks) price has increase at least 10% over the 2 year period. This is about 42.86% of the total stocks that passed the 5 criteria.

From the above, in conclusion, it can be deduced:

1. If a stock pass more criteria, it will have a higher probability that the price will increase

2. Share prices in 2014 has significantly increased from 2013 level.

3. The period in 2015 when STI fell significantly has lowered the probability for the 1 year period from 2014 to 2015.

4. The longer you hold a fundamentally strong stock, the higher the probability you will be able to sell it at a profit.

5. There is generally a 50% chance the stock will rise within 2 years if it pass these criteria.

6. Even if the stock only increase by a mere $0.01 over a period of 2 years, the dividend that the stock may produce will still tend to give you 3% return a year.

(Note that no transaction cost is taken into account for the calculation above.)

In short, I believe using fundamental analysis, such as the V Scorecard, is better than not using anything to analyze a company's financials before buying it. Although it does not guarantee every stock to be a winning investment, but it still give you a higher chance that you will gain eventually.

Preliminary Stocks Analysis

Chuan Hup Holding Ltd - Still remains a Value Stock based on 1st Q results for 2016 and price of 0.305. Had a score of 10. However, do note that it remains a concern that the company have heavy investment in Australian Properties. Write downs are still possible. Nevertheless, the fundamentals of the company is strong due to its subsidiary PCI. Will most probably add to my position if the price continue to fall.

TTJ Holdings Ltd - Still remains a Value Stock based on 4th Q results in 2015 at price of 0.395. Had a score of 10. Another update should be done after Ex-Dividend Date.

Powermatic Data Systems Ltd and Hong Fok Corp Ltd - Both receive a score of 7 and did not qualify as a Value Stock at the current price. Both company are VERY asset rich. But as V Scorecard requires a reduction of revaluation or fair gain in the asset from the net profit, this significantly reduces the earning abilities of the companies.

Please do remember that V Scorecard will only provide the quantitative aspects of the company. It is still important to review the qualitative aspects of it as well. A review of the company as a whole is very important.

Finally, regardless what the V Scorecard tells you, you still have to do your own due diligence and your own views.

A friend once said, my strength is in screening of stocks, not finding the winning investment.

A friend once said, my strength is in screening of stocks, not finding the winning investment.

Interested - Message/Comment on the Facebook post or this post below

As stated, I will like to start coaching/guiding/spreading my knowledge to others. The course will consist mainly around the V Scorecard on the way to use it accordingly to your own knowledge and experience.

No details have been set. But if you are interested, just message or comment in the Facebook post or this blog post below and I will contact you accordingly.

As stated, I will like to start coaching/guiding/spreading my knowledge to others. The course will consist mainly around the V Scorecard on the way to use it accordingly to your own knowledge and experience.

No details have been set. But if you are interested, just message or comment in the Facebook post or this blog post below and I will contact you accordingly.

I will also not be forgetting my existing users of the previous scorecard. I will send it to you by this Friday.

For new users who are interested in the V Scorecard, do just contact me via email, Facebook or this blog. I will send you accordingly.

Oh...and help me like my Facebook Page - T.U.B Investing.

Hi, Great research done there. I am also trying to do a back test. May I know how do you do a screening on stockflo screener for a particular year(eg 2013)? Thanks!

ReplyDeleteHi Mr Savy,

DeletePlease contact Wilson directly as per comment below.

Hi Mr Savy,

ReplyDeleteI am Wilson from Stockflock. Thank you for asking the question. Currently our design for back testing is not yet completed so it is not accessible to public yet. If you need help with screening for past years, you could email me at wilson@stockflock.co and we will try to assist you.