Evaluating Geo Energy Resources' Outlook Post March 2024

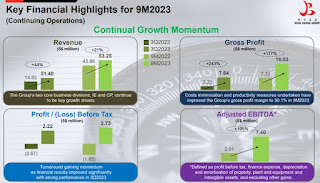

Vested Prior to commencing, I must acknowledge that my previous post on Starhill Global REIT received substantial critical responses. Members in my Telegram group (Link in this post ) pointed out loopholes in my article. Specifically, they highlighted that while the REIT boasted high occupancy rates, its revenue from properties outside of Singapore was dwindling. Furthermore, the dividend had experienced a consistent decline over the years, suggesting inadequate management. Hence, if you are contemplating an investment in Starhill REIT, do think twice - although I remain vested for now. On a different note, I previously also wrote about Geo Energy Resource ("GER") (SGX: RE4.SI) , and this article serves as a continuation of my previous piece. Although the time-sensitive information has now been disclosed and March 2024 is coming to an end, I still remain vested in GER. As we approach the end of March 2024, the question arises: what will happen if I continue to hold onto G